The RBA board has decided to hold the official cash rate at 4.35% in the final board meeting of 2023.

With you on your property journey

First Home Buyer

The 20% deposit myth

If you want to buy before you reach that 20% mark then you can absolutely and completely get a loan with a smaller deposit. Let us show you how!

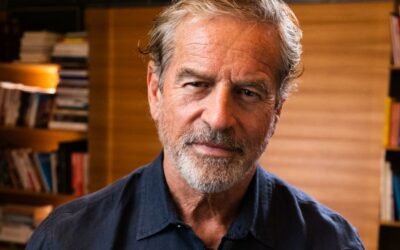

‘I’ve never seen anything like this’ Mark Bouris’ grim prediction

Mark Bouris has said he’s “never seen anything like this” as people try to get home loans amid a crisis he believes Labor is stoking.

The Rate that Stops the Nation

The RBA has delivered an increase of 0.25% to the official cash rate, leaving it at 4.35% for November.

Understanding Comparison Rates: The Real Cost of your Home Loan

Comparison rates were introduced by the Federal Government as a way to standardise and simplify how lenders presented home loan costs to consumers. Understanding this rate, will help you make better decisions.

What kind of borrower are you?

Whether you’re taking out a loan for personal or business reasons, understanding how different types of borrowers manage their loans is essential to getting ahead financially.

How to make your home (equity) work for you

Are you wondering how to leverage your home equity for a brighter financial future? Learn more about this financial strategy and discover the steps to access your equity.

Guarantor Loans: What You Need to Know

Learn about guarantor home loans, how they can reduce the deposit needed to buy a home, who can be a guarantor, and their advantages and risks. Discover why consulting a financial advisor or attorney is crucial before committing to this arrangement to protect all parties involved in property ownership.

What is home loan serviceability?

“How much can I borrow?” – The answer will always be dependent on your ‘serviceability’, determining your financial capacity for a secure loan.