This week the RBA lifted interest rates by a further 0.25%, bringing the official cash rate to its highest point in over a decade, at 3.85%. This latest rate hike left many bewildered, as homeowners continue to suffer more than most due to the RBA remaining intent on...

With you on your property journey

Interest Rates

13 months, 11 Rate rises: RBA Decides to Hike Again

The RBA Board has officially decided to increase the cash rate by 25 basis points to 3.85%.

Interest rates on hold but where to for property prices?

Mark Bouris has told Sky News Australia that homeowners should prepare for further interest rate rises, following Tuesday’s RBA decision to hold the rate.

“Big Problem”: Fixed-rate mortgage cliff looms large

Over 1.2 million Australian homeowners are expected to be making mortgage repayments three times their current level.

Interest Rates to be Cut?

Will the Reserve Bank of Australia (‘RBA’) need to recalibrate its aggressive rate hiking strategy?

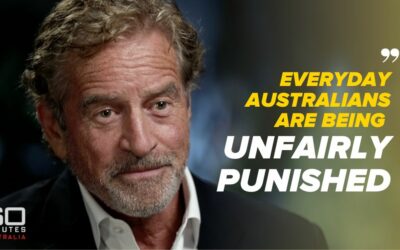

Homeowners being “unfairly punished”: The problem with consecutive rate hikes

“We’ve got to get inflation under control”

10 Months of Rate Hikes: Here’s what it means for your repayments

The Reserve Bank of Australia (‘RBA’) has decided to raise the official cash rate for the tenth consecutive time.

Interest rates have not hit “peak” levels: Heat Turns up on RBA Governor

The pressure continues to mount on RBA’s Governer following latest cash rate announcement.

Have We Gone “OVERBOARD” with Rate Rises?

Yellow Brick Road Home Loans Executive Chairman Mark Bouris told Sky News that Australia is very close to “going overboard”.