In this article:

Too many Australians have a ‘set and forget’ approach to their home loan. Throughout your time as a homeowner with a mortgage, your personal circumstances can drastically change, and the home loan deal you have for one year may not be the most affordable option for you a year later.

You may receive a substantial pay rise and can therefore afford to make larger repayments, meaning you can pay off your home loan sooner.

Whatever your reasons, your home loan needs to be reviewed every one to two years to ensure you’re getting the most out of your loan. To do so, there are numerous considerations to understand so that you refinance to the right loan for you. Here are four key factors to consider before refinancing:

1. Loan Tenure

Many borrowers can be enticed into refinancing through ‘cash-back’ offers or other marketing techniques by many lenders. For others, the motivation to refinance boils down to strategising to pay off your mortgage more quickly or to save money. It can be easy to fall into refinancing that may seem cheaper because of a lower headline interest rate, but in the long run, financially, you’re worse off if you switch to a new home loan for a longer term.

Here is an example:

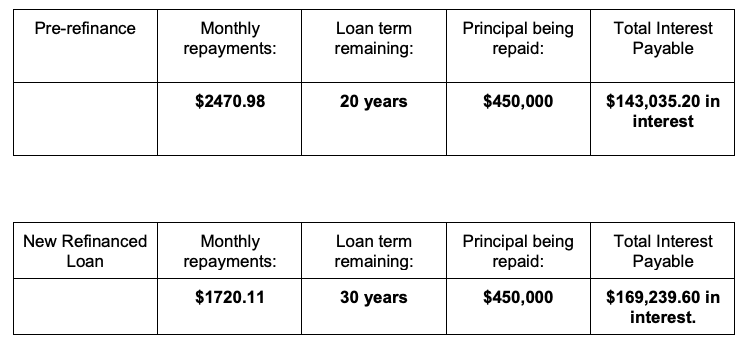

Stacey took out a home loan 10 years ago with an original term of 30 years. She still owes $450,000 at a current interest rate of 2.89% p.a. Stacey’s minimum monthly repayments are $2,470.98.

Whilst this is a reasonably competitive rate, she knows that she will find a better deal.

Stacey decides to refinance with a new lender. Her new interest rate is 2.25%, over a 30-year loan term for the same amount of $450,000. Stacey’s monthly repayments are now $1,720.11.

Stacey appears to be streets ahead, but looks can be deceptive. Most of these monthly cash flow savings are driven by the longer loan term. Instead of having 20 years of repayments left, Stacey now has to continue making repayments for a further 30 years.

In fact, while the new interest rate is lower, the total interest bill for Stacey is now going to be higher than if she remained with her existing loan deal, simply due to the additional length of the new loan term.

So, Stacey’s new loan will cost her an additional $26,000 in interest.

However, it is possible for Stacey to refinance in a way that leads to a win for her.

Stacey could:

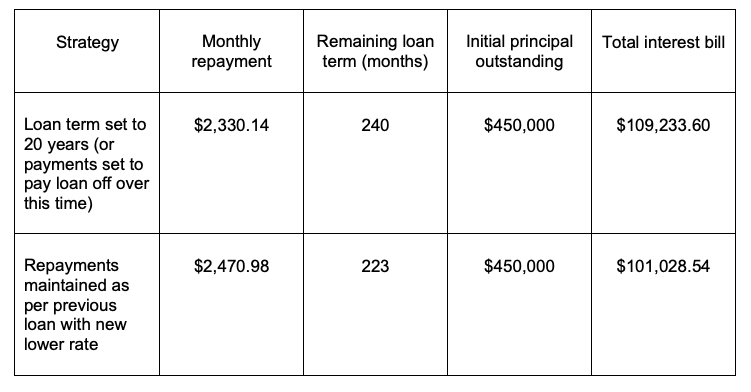

- request that her lender set her new repayments so that the loan is paid off in 20 years, or

- keep the previous repayment schedule with the new lower interest rate.

These strategies turn a $26,000 additional interest bill into significant savings:

If Stacey makes these simple requests, she can ensure that whatever deal she refinances to, her repayment schedule remains the same but at the new, lower interest rate. It could result in a $60,000 turnaround in savings based on a simple request.

The key takeaway for any borrower is the need to be wary of any lenders or brokers that focus only on the monthly savings, as this is not the full picture.

As you can see, it might be easy to assume that you’ll pay less for a home loan that has a lower interest rate, but you must consider the loan tenure and how that will impact your repayments.

2. Flexibility

This is crucial for the savvy borrower. By increasing your repayment size or the frequency of your repayments (and in some cases, increasing both) will give you a fantastic chance at paying off your loan sooner. Some home loans have restrictions on your ability to pay in a larger amount or more frequently. Often, mortgage repayments are scheduled either weekly, fortnightly or monthly. Naturally, making repayments weekly will increase your chances of paying off your home loan sooner. You want to ensure that any loan you refinance gives you the flexibility you need to expedite paying off your loan and owning your home.

3. Loan Features

Loan features can be crucial tools in your tool belt to help you pay off your loan sooner, as long as you understand how the feature works and strategise about how to optimise each feature. Some common loan features include a redraw facility, offset accounts or split loan options. Working with a mortgage broker can help you to understand each of these features, and they can help you identify which loan options have the features you need.

Once you learn about the benefits of some home loan features, your broker can ensure your loan has the right features for your circumstances. Having the ability to access additional funds that you’ve paid into the loan will increase your likelihood of additional repayments, meaning you save on your loan repayments in the long run.

4. Fees

When you refinance your home loan, you potentially make some substantial savings over the long run, but you have to consider the costs involved in making the move from one loan to another. It’s in your best interests to discuss the costs of refinancing with a mortgage broker before you make any commitments, but here are some of the costs that may be involved in refinancing:

Discharge Fee: Your existing lender may charge you a fee for the administration work associated with you having to exit your mortgage early.

Mortgage registration Fee: this is a state government fee charged for registering your new home loan. The amount of this fee varies from state to state. Your new lender collects the cost of the fee from you and pays it to the relevant government party.

Fixed Loan Break Fee: If you have a fixed-rate loan, you may well be charged to finish it early (i.e., for ‘breaking’ the term of the loan). This fee might be charged by your existing lender for refinancing before your fixed period is over. Your break fee is not determined until such a time that you decide to repay a fixed rate early because the fee is determined by market rates at the time you took out the loan, as well as your rate at the time you are looking to unwind your fixed rate.

Exit Fee: They are charged by your lender when you break the term of your loan agreement and can amount to a few thousand dollars. It’s important to weigh up the cost of breaking your loan against the benefits of refinancing, as there may be other costs associated with refinancing that outweigh the exit fees. Generally speaking, if your exit fee falls between $300 – $500, then you may not be receiving the best deal.

Settlement Fee: this is charged by your new lender to cover the costs associated with paying out your existing lender and organising the switch to your new home loan.

Property Valuation: If you decide to refinance to a new lender, the new lender may require a valuation of your property to be completed to determine its current market value. This can influence your maximum loan amount and assess how much equity you have built up in the property.

Lenders Mortgage Insurance: Lenders usually charge LMI when you borrow more than 80% of the property value, so if your current mortgage still owes more than 80%, when your new refinanced loan is settled, you may be charged LMI for a second time, to settle the new loan.

Title Search Fee: A title search fee is a charge assessed by your lender for ensuring that there are no outstanding claims on your property. This fee covers the cost of checking the public records to confirm you are the legal owner of the property.

It all boils down to your unique circumstances and your motivations for refinancing. It can be a great way to tap into the equity within your home or to consolidate other debts. Chatting to a mortgage broker about all the factors you need to consider before refinancing will cost you nothing, as generally, the fee for a broker’s service is paid for by the lender, not the borrower.

So reach out to us today to chat with one of our experienced YBR Home Loans brokers, who can do the heavy lifting for you and give you a cost-benefit analysis for your refinancing plans.