In this article:

Which is better for you: a fixed rate or a variable rate home loan? This is a question that many borrowers are asking themselves in Australia right now. The mortgage market is shifting dramatically on short notice due to external influences.

When we analysed the percentage of borrowers opting for fixed rates vs variable rate home loans, we found some interesting numbers. But why is this the case? Let’s take a closer look at the trends in the Australian home loan market and see what’s driving borrowers towards one type of loan over another.

Average number of Australians opting for fixed rates

Generally, the average percentage of borrowers opting for a fixed rate product throughout any month of the year sits around 10% of all loan products borrowers purchase. This means, generally, an average of 90% of all home loans settled are variable rate products.

During the COVID era, however, we saw significant changes to this average. Likely due to the extraordinarily low fixed rates on offer throughout the past two to three years, there was a significant increase in borrowers opting for fixed-rate home loans.

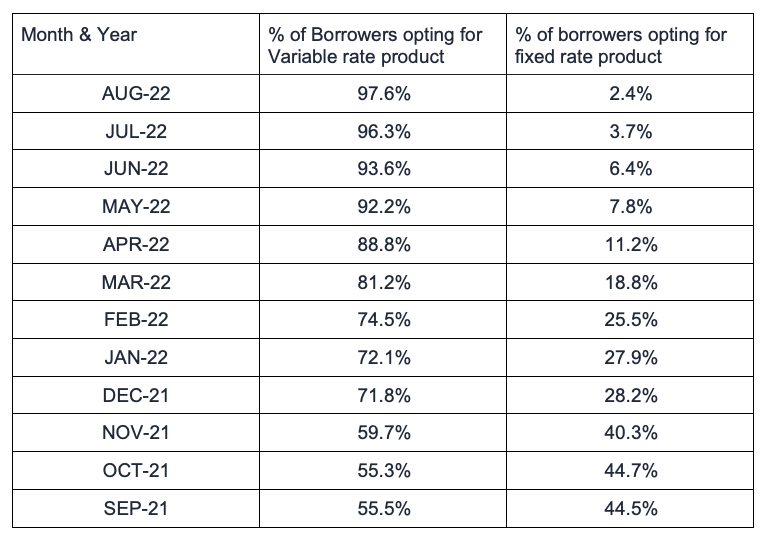

We analysed home loan settlements across the VOW & YBR Home Loans network over the last year, which is a fair representation of the broader home loan market, and found the below:

As you can see, over the last 12 months, the percentage of borrowers opting for fixed-rate home loans has gone from 44.5%, over four times higher than the long-term average (around 10%), to just 2.4%, or around ¼ of the long-term average. There are a few factors that contributed to this shift from all time highs to extreme lows in the number of borrowers opting for fixed rates:

- The rise in fixed rate settlements (which peaked at 44.7% of all loan settlements) was largely due to the extremely low fixed interest rates on offer as a result of the RBA’s emergency monetary policy settings.

- As interest rates have soared in 2022, a combination of fixed interest rates increasing significantly above the variable rates on offer at the same time and the declining borrowing capacity of many borrowers has seen a drastic decline of borrowers opting for fixed interest rates.

In terms of how the rates can impact on borrowing capacity, consider the following example:

The best 3-year fixed rate product available in the first week of September 2022 from a major bank was 5.89%, whereas the best variable rate from the same bank was 3.79%.

Say Justin was looking to borrow to purchase his first home and intended to apply for an owner-occupier home loan, the maximum amount Justin would be able to borrow under a fixed rate was approximately 18% less than what he could borrow under a variable rate home loan.

Why does this matter?

The reason behind highlighting these facts is to emphasise that now might not be the best time to fix your interest rate, as there is quite the premium currently built into fixed interest rates. Compounding this is the fact that to qualify for a fixed interest rate, your borrowing power will likely reduce because most fixed rates right now are sitting higher than the most competitive variable rates.

It’s possible that the premium currently built into most fixed interest rates will be lower in the near future, once interest rate hikes cease and there is more stability in the property market, but now is the time to engage an experienced and trusted mortgage broker to help you navigate what can be a complicated and stressful home loan market.

Get the right advice

When it comes to your mortgage, the most important thing is that you choose one that suits your personal situation.

If you’re interested in learning more, why not have a no-obligation, free chat with a Yellow Brick Road adviser, who can point you in the right direction?