In this article:

House prices in Australia are a hot topic right now. Depending on the source, you’ll hear different answers about where the market is headed. If you just focused on mainstream media publications, you might be inclined to believe that house prices in Australia will plummet by 20% over the coming year as interest rates rise.

Stephen Koukoulas and Mark Bouris addressed this very issue on Property Insights, to stress that a 20% fall in house prices is no certainty. In fact, history suggests that patience is a virtue when it comes to interest rate hike cycles.

Is the inflation story ‘fake news’?

Of course, inflation is real and it’s here. We’re all feeling the pinch of the increasing costs for everyday items.

“It’s real news in that the price of things is going up,” said Koukoulas, “But, in my analysis and observation of commodity prices, inflation is starting to peter out already.”

“Yes, the price of a lot of these things, be it petrol or whatever, they are high, there’s no question. But, and it’s an important ‘but’, we do have evidence that a lot of these prices are coming back down. And it takes a while for it to be passed through from the shipping company to the trucking company, to you and me when we go out and buy stuff on the street.”

“So yes, the inflation rate is correct, but I suspect that when we start to get these supply chain issues resolved, we’ll be shocked in 12 to 18 months’ time about how low inflation will be.”

What about house prices?

Many experts and commentators are tipping house prices to crash. While house price growth is slowing, history suggests now is not the time to sell.

According to Koukoulas, unfortunately, “there is also a lot of poorly informed emotion around the impact of interest rate hikes and the effect on ‘stressed’ and ‘stretched’ mortgage holders, none of which has much substance” when you look at historical facts.

Koukoulas pointed out that history suggests house prices generally stay the same or increase on average, following a rate hike cycle: “It is quite rare for rate-hiking cycles to coincide with falling house prices”.

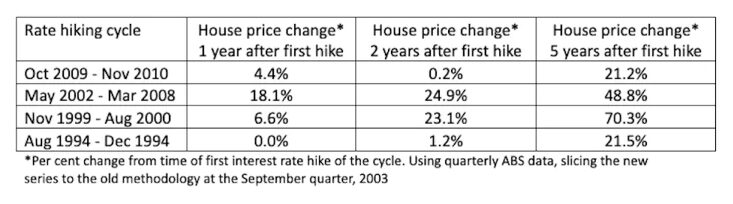

“Not counting the current interest rate cycle, there have been four instances in the past 30 years where the RBA has implemented an interest-rate-hiking cycle:

- August 1994 to December 1994 – Cash rate up 275 basis points (or 2.75%).

- November 1999 to August 2000 – Cash rate up 250 basis points (or 2.5%).

- May 2002 to March 2008 – Cash rate up 300 basis points (or 3%).

- October 2009 to November 2010 – Cash rate up 175 basis points (or 1.75%).”

“In each one of these four cycles, house prices were flat or higher – both one and two years after the first rate hike.”

“Five years after the first rate hike in each cycle, house prices were on average around 40% higher.”

“Looking at house prices five years after the last hike in the cycle, they were always higher, with the average gain around 30%. It is also noteworthy that house prices recovered after the flat patch in the wake of the 2009-2010 cycle, to be 26.1% higher five years after the last hike in that cycle,” said Koukoulas.

Patience is key

There are a number of factors that influence house pricing. Mark was keen to stress to viewers of Property Insights that it’s best to focus on what the Reserve Bank says after their meeting on the first Tuesday of every month:

Mark said: “Everyone’s playing a game here. The RBA is gaming, the government is gaming, global leaders are gaming, the consumers are gaming, the real estate agent is gaming, and the media is gaming. They’re all gaming…they’re all trying to take advantage of situations that are occurring.”

Mark’s advice is to, “arm yourself with knowledge and information and stay patient. If you’re not facing too much financial pressure, try not to panic. Take a step back, breathe.”

Koukoulas agrees, reminding listeners that buying a house, especially to live in, is no short-term investment.

“For owner-occupiers, it is at least a 10- or even 15-year purchase plan,” said Koukoulas, “which means changes up or down in prices in the short term have little influence on sentiment towards what, for most, is their greatest asset.”

“The RBA started the current rate-hiking cycle just last month and, if the market pricing is correct, the RBA will deliver the largest hiking cycle in 30 years.”

“The cash rate will rise by a total of approximately 375 basis points, with the peak priced in for the middle of 2023.”

“Unrelated to the rate hikes in the past six weeks, there are signs house price growth is already cooling, maybe even registering small falls.”

“History suggests that as the cycle unfolds, house prices will be flat to slightly down over the next year or two.”

However, a “weakish year or two for house prices would be no surprise” considering the enormous growth in house prices across the country over the previous two years, where interest rates were at historically low levels.

Where is Koukoulas tipping house prices to go five years from now?

He said: “My money is on prices being a good 20-30% higher than they are today, even if they do dip a little in the next 12-24 months.

So, you may not see it very often across your daily news sources, but the evidence suggests that five years after a rate hike cycle, house prices increase in leaps and bounds.

This in no way suggests that interest rates have no impact on house prices. We know that interest rates are a major factor, but it’s one of many factors at play, and there’s no evidence to suggest that a rate hike cycle leads to a ‘crash’ in property prices. As Koukoulas said, “the media have got to be careful, and you have got to be careful when you read this stuff.”