In this article:

If you’re one of the many Australians who took out a fixed-interest rate mortgage in the last two years, you may be about to experience a bit of a shock when your fixed period ends, and your loan reverts to a variable interest rate.

In the last seven months, variable interest rates have increased significantly in Australia. This can lead to dramatic increases in your monthly mortgage repayments – something that many homeowners may be unprepared for.

So how can you maximise the benefits of your remaining fixed rate period to minimise any potential loan repayment shock? Let’s dive in.

Fixed Rate Period about to end?

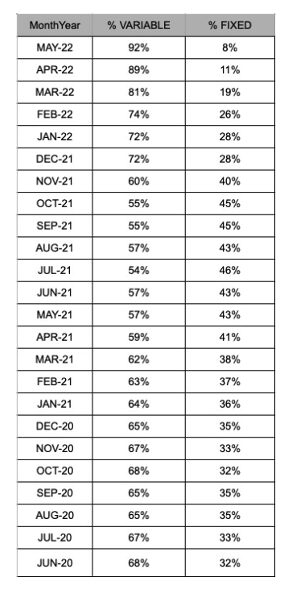

During 2020 and 2021, a record number of Australian borrowers took out fixed-rate home loans. From January 2021, a significant portion of these fixed-rate home loans were taken out with a two-year fixed-rate period, to then revert to the variable rate.

This means that as of January 2023, a large number of Australian mortgage owners are going to experience a significant increase to their monthly repayments, when their fixed-rate home loan reverts to a variable interest rate.

So what can you do to prepare for your fixed rate period ending?

Ensure your revert rate is competitive

The first step to preparing for the end of your fixed-rate period is to make sure that the variable interest rate you will be reverting to is competitive. You should compare variable interest rates offered by different lenders, as rates can vary significantly. If you’ve approached your home loan strategically, and engaged a mortgage broker from the offset, then they would have ensured that your revert rate was going to be a competitive one when you put in your original loan application.

If you weren’t too fussed about your revert rate and were just shopping around for the lowest fixed rate possible, then you may not be reverting to a competitive rate. If you initially took out your loan by going directly to your lender, you can approach them and enquire about whether your revert rate is the best offer they have. However, their offer may not be the most competitive variable rate out there and it always pays to do a little bit of research to see what competitors are offering.

If you’re a borrower who is reverting to a variable interest rate, and you’ve managed to pay off some of your home loan during your fixed period, then you may be in a stronger bargaining position with your lender. You can approach your lender and ask for a better deal on your variable interest rate. This could include a lower interest rate, or even waiving some of the fees associated with your home loan.

Whilst you won’t be able to improve your interest rate on your fixed-rate period, it’s always worth asking in advance whether your lender can provide a better variable rate for the remainder of the overall loan term. If they say no, then you can always shop around for a better variable interest rate from another lender. It’s important to remember that lenders are competing for your business, so it never hurts to ask for a better deal.

Lean on expert advice

Mortgage brokers in Australia can offer borrowers a range of benefits that you may not be able to get on your own. For example, a mortgage broker may be able to find you a better variable interest rate than the one you were offered by your lender. They may also be able to negotiate a lower interest rate for you, or even get the lender to waive some fees.

If you’re not sure where to start when it comes to comparing rates, or you feel like you’re not getting the best deal from your current lender, then it’s definitely worth engaging the services of a mortgage broker.

There is a reason why over 67% of all residential home loans in Australia were facilitated by Mortgage Brokers.[1] Brokers must act in your best interests and have access to many different lenders and products, so they can help find the best deal for you.

They can also help you with other aspects of your home loan such as repayment strategies and budgeting for your mortgage. If you’re feeling overwhelmed by your home loan or just need some guidance, then a mortgage broker is a great option.

If you have some lead time before your fixed-rate period ends, you may be able to strategise with your broker to pay-in more for the remaining period, although many fixed-rate home loans don’t offer this flexibility.

Another option worth exploring is reaching out to your mortgage broker to discuss whether you might be able to refinance to a better deal when your fixed period ends. Your broker will know when your fixed-rate period ends, and as a team, you can work on a strategy with your lender to start the process of refinancing, so that you can time your refinance to kick in a day or two after your fixed rate period ends. This can be tricky, so you want to make sure you’ve got all the details from your trusted mortgage broker.

Consider a split-rate home loan

Whilst it may not be a viable option immediately, once interest rates reach their expected peak, we anticipate a time when it may be worth considering a split-rate home loan, which allows you to have part of your mortgage on a fixed interest rate and another portion at the variable rate.

This way, you will be able to plan for the increase in repayments when your fixed-rate period ends, and still benefit from the security of a fixed rate for a portion of your mortgage.

Read more about the benefits of a split home loan here.

Start budgeting for higher home loan repayments

While it can be easy to forget about when you’re enjoying the benefits of the great decision you made to fix your interest rate a few years ago, being prepared for increased mortgage repayments can help you avoid any nasty surprises. Now is the time to plan ahead and budget for any potential increase in your monthly mortgage repayment.

Start by looking at your budget and seeing where you can make cuts in order to free up more money for your mortgage repayments. This could include reducing eating out, cutting back on non-essentials, and finding ways to bring in a little extra income through side hustles or selling items online. It’s important to be realistic about the amount of money you will need each month when your fixed rate ends and to factor this into your budget.

Avoid the panic

Overall, it’s important to keep in mind that variable interest rates are on the rise and taking proactive steps now will help ensure that you don’t experience any nasty surprises when your fixed-rate period ends. Taking advantage of a split-rate home loan or engaging with a mortgage broker may be the key to maximising your fixed-rate period while avoiding any rate shock.

By understanding how to best prepare for the end of your fixed-rate period, you can ensure that your home loan remains a source of security and stability, rather than a source of financial stress.

If you’re not happy with the interest rate your lender is offering you, it’s time to start shopping around. There are plenty of other lenders out there who may be able to offer you a better deal. The best place to start can be simply searching online for a comparison tool to get a better understanding of the best deals out there.